Most recent

Gavekal Research

Video: How Long A US Haven?

Tan Kai Xian

12 Mar 2026

Since the United States-led war against Iran started, US assets have received a safe-haven bid. This reverses a narrative that had taken hold among global investors before the outbreak of hostilities to sell an increasingly unreliable America. The argument had developed that the US was proving a bad partner and pursuing currency debasement policies. In this video interview, Kai Xian discusses whether such a “sell America” trade had ever actually started and, looking through this war, what happens next to capital flows.

Gavekal Research

Asia’s Energy Shock

Tom Miller, Udith Sikand

12 Mar 2026

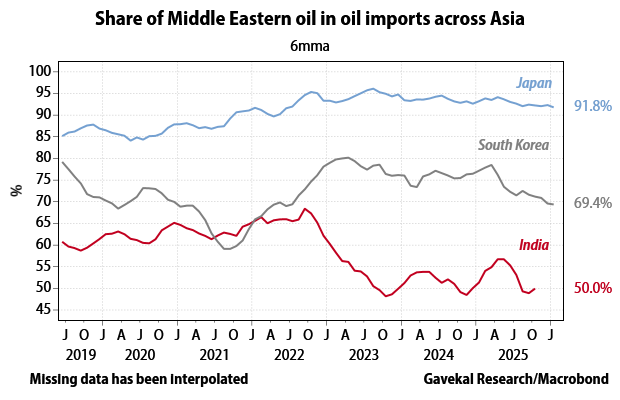

The recovery in Asian markets stalled on Thursday, despite the International Energy Agency’s decision to release 400mn barrels of oil from global strategic reserves. Asia’s outsized reliance on trade routes via the Strait of Hormuz means it remains vulnerable to the oil and gas squeeze in the Middle East. For Asia’s emerging economies especially, this spells weaker currencies, rising bond yields and slower growth.

Gavekal Dragonomics

Out Of Deflation, Into Cost-Push Inflation

Thomas Gatley, Wei He

12 Mar 2026

The rise in global oil prices driven by the unfolding Iran conflict has one silver lining for China: it will make it easier for the government to fulfill its pledge to “steer general price levels back into positive territory.” The mechanical effects of higher commodity costs will almost certainly drive headline price measures out of their long run of deflation in coming months. But Thomas and Wei point out that cost-push inflation in an environment of weak demand is going to be negative for China’s corporate margins, investment and real growth.

Gavekal-IS

Rare Cases Of Risk Asymmetry

Didier Darcet

11 Mar 2026

The broad market shock induced by the Iran War has thus far been contained, says Didier. In this piece, he seeks insights from oil-market pricing to test if that reaction is justified. By looking at the dynamics in the spot and futures markets for crude, he concludes that investors are being rational and should keep the faith with risk assets.

Gavekal Dragonomics

Pressure Builds On Local Officials

Andrew Batson, Tilly Zhang, Christopher Beddor

The Bargain In The Five-Year Plan

Andrew Batson

Dialing Back Fiscal Stimulus

Wei He

A Comfortable Bystander

Arthur Kroeber

Venture Capital Rebounds

Tilly Zhang, Xiaoxi Zhang

Gavekal Research

Exogenous Shocks And Bond Returns

Louis-Vincent Gave

Exchange Rates And Oil Shocks

Charles Gave

Webinar: The War And Markets

Charles Gave, Louis-Vincent Gave, Arthur Kroeber

Hedging In A Time Of War

Will Denyer

On Price Controls And Export Restrictions

Louis-Vincent Gave

Gavekal Technologies

China Targets Full-Chain Chip Breakthrough

Laila Khawaja

Will AI Supercharge The China Shock?

Laila Khawaja, Tom Hancock

China Enriches Export Control Toolkit

Laila Khawaja

Washington’s AI Anxiety Rises

Laila Khawaja

US Biotech Is Safe From China (For Now)

Tom Hancock, Laila Khawaja

Gavekal-IS

The Global Portfolio Regatta

Didier Darcet

Money Creation, Interest Rates And Wealth Creation

Didier Darcet

Time To Take Profits On Metals?

Didier Darcet

The Big Long 2.0

Didier Darcet

Measuring Imitation

Didier Darcet

Gavekal Research

Geoeconomic Monitor: Who’s The Real Winner?

Tom Holland, Tom Miller

6 Feb 2026

Donald Trump says India has agreed to stop buying Russian oil and funding Vladimir Putin’s war machine. And in Panama the annulment of CK Hutchison’s ports contract means Trump can finally claim to have “taken back” the canal. The reality in both is less black-and-white.

Checking The Boxes

Our short take on the latest news

Fact

Surprise

Takeaway

US CPI rose 2.4% YoY in Feb, the same pace as in Jan

As expected; core CPI rose 2.5% YoY in Feb, the same pace as in Jan

Sustained uptick in oil prices likely to boost inflation readings ahead

US federal budget deficit widened to -US$307.5bn in Feb, from -US$307bn in Jan

Narrower than expected -US$310bn

Deficit likely to widen as tariff revenues set to fall even as expenses mount

Spain retail sales rose 0.1% MoM in Jan, up from -0.9% in Dec

NA; YoY, retail sales rose 4% in Jan, up from 2.8% in Dec

Resilient household demand likely to remain key driver of growth ahead

Brazil retail sales rose 2.8% YoY in Jan, up from 2.4% in Dec

Above expected 1.6%

Despite tight monetary policy, resilient jobs market underpins uptick consumer spending

Test Your Knowledge

Most major religions saw the number of their faithful grow from 2010-2020. Which was the exception?

- Hinduism

- Buddhism

- Judaism

Chart of the Week

Asia heavily relies on imported oil, with major economies importing more than 90% of their total consumption. Much of this supply comes from the Middle East, leaving Asia particularly exposed to disruptions caused by the ongoing war in Iran.

Open Chart

Gavekal Research

Essential Reading: A Book For Every Week Of The Year

Gavekal is often asked for a recommended reading list. So, here it is: a book a week that everyone interested in the world of macro investing—whether hoary veteran or eager apprentice—can benefit from reading.

Gavekal Research

Webinar: The War And Markets

Charles Gave, Louis-Vincent Gave, Arthur Kroeber

10 Mar 2026

Since the US and Israel launched decapitation strikes against Iran’s leadership and oil and gas infrastructure has been targets of attacks, global markets have been rocked by uncertainty over how long Middle East energy supplies will be disrupted. Our panel assess the latest geopolitical situation and aims to map a path on what comes next for markets.

Tariff Troubles

After The SCOTUS Tariff Ruling

The shift in the tariff landscape following the US Supreme Court’s ruling on Friday that all tariffs imposed by Donald Trump under IEEPA—the 1977 International Emergency Economic Powers Act—are illegal is good news for equity investors. But it is not great news, writes Will Denyer.

The EM Triple Whammy On Full Display

It would be tempting to ascribe the simultaneous US dollar, bond, and equity market sell-off to the self-owned “crisis” around Greenland and to Trump’s threat to use tariffs against (former?) friends to force a change of sovereignty. Still, the current sell-off in bonds, and equities, may also be driven by other important factors, says Louis.

How Europe Will Respond To Trump’s Greenland Tariffs

On Saturday, US president Donald Trump threatened new tariffs on eight European countries over their opposition to his plans to annex Greenland. Since then, attention has shifted to how Europe might respond. Cedric argues that conciliation and deescalation remains Europe’s first response to Trump’s new tariff threat, but there is now a greater chance that the EU retaliates in earnest if that strategy fails.

Video: Supreme Court v. Trump’s Trade Policy

Initial questioning by US Supreme Court justices in a landmark trade policy case suggests that a majority believe the Trump administration unlawfully invoked emergency powers to impose broad tariffs on importers. In this interview, Will outlines the key issues at stake and considers Trump’s possible next steps if the government loses.

US economy & markets

Hedging In A Time Of War

War is punishing for portfolios, especially when it disrupts the flow of oil and gas. War can also affect markets through higher government borrowing, rising inflation, differing monetary policy responses and changes in the economic outlook of affected regions. The effect of these forces may explain why some hedges and safe havens have underperformed during the first week of the US-led war against Iran, says Will.

Picking Up Loans On The Cheap

As the US-led war in Iran consumes international investor attention, private credit concerns continue to bubble up within the US itself. Practitioners such as Blue Owl and Blackstone have seen their share prices crater as investors question the quality of non-bank, privately negotiated lending. The sell-off raises four questions.

US Banks And The NatSec Intersection

US bank stocks took a beating Monday, with the S&P 500 bank index falling a painful -4.3%—almost as much as US software stocks. But Kai Xian argues that banks are emerging as one of the most promising ways to play the US government’s drive to step up investment in US national and economic security, and the recent fall may provide a buying opportunity.

After The SCOTUS Tariff Ruling

The shift in the tariff landscape following the US Supreme Court’s ruling on Friday that all tariffs imposed by Donald Trump under IEEPA—the 1977 International Emergency Economic Powers Act—are illegal is good news for equity investors. But it is not great news, writes Will Denyer.

China chartbook

Gavekal Dragonomics

Macro Update: Preparing For Normalization

Wei He, Dragonomics Team

4 Feb 2026

China’s policymakers are satisfied with economic performance in 2025, and appear confident that 2026 will be a more ordinary year that allows for a more normal policy stance. But domestic demand remains lackluster, and it’s unclear whether recent positive momentum in some areas can be sustained. In their latest quarterly chartbook, Wei and the Dragonomics team take stock of China’s economic performance and the outlook for the year ahead.

India chartbook

Gavekal Research

India Macro Update: Downside Risks Abound

Udith Sikand, Tom Miller

23 Sep 2025

India’s domestic economic recovery is at risk as Prime Minister Narendra Modi’s government faces a lose-lose choice: continue to import cheap oil from its long-time ally Russia or face punitive tariffs in its biggest export market. Last week’s US interest rate cut will give the central bank more room to cut rates, but the underperformance of Indian asset prices looks set to continue.

Latest video

Gavekal Research

Video: How Long A US Haven?

Tan Kai Xian

12 Mar 2026

Since the United States-led war against Iran started, US assets have received a safe-haven bid. This reverses a narrative that had taken hold among global investors before the outbreak of hostilities to sell an increasingly unreliable America. The argument had developed that the US was proving a bad partner and pursuing currency debasement policies. In this video interview, Kai Xian discusses whether such a “sell America” trade had ever actually started and, looking through this war, what happens next to capital flows.

Strategy Chartbook

Gavekal Research

Global Strategy: Best And Worst Trades For 2026

Louis-Vincent Gave, Charles Gave, Anatole Kaletsky, Will Denyer, Tan Kai Xian, Cedric Gemehl, August Gudmundsson, Thomas Gatley, Udith Sikand, Tom Miller

8 Jan 2026

Past performance is no guide to future returns, and the trend is not always your friend. As such, Gavekal writers consider their most compelling 10 macro trades for 2026, on both the upside and the downside. If one theme runs through our developed-market views, it is the expectation for a sustained inflationary boom. That story is different in China, but Chinese firms look to be on the right side of an energy transition with room to run. The view on gold is nuanced, especially seen through the lens of Japanese investors facing extreme asset valuations.

Emerging markets

Video: Are EMs Back?

It’s been a good quarter for the broad emerging markets complex. The MSCI EM index has returned almost 7% in US dollar terms, while US equities are down by some -3.5%. So should investors jump on the EM train? Udith points out that there is a wide divergence in the performance of individual emerging markets, and the threat of tariffs hangs heavy over EM corporate earnings. Investors need to be selective.

Video: Southeast Asia Under Trump 2.0

Global investors are rightly focused on the potential losers from the United States pursuing an aggressively protectionist trade policy agenda, but there may be winners as well. Tom went in search of such economies last week. Today he explains how such “swing states” are likely to perform in an intensified period of great power rivalry between the US and China.

China Turbocharges EM Investment

As the rich world pulls up the protectionist drawbridge, investors risk missing a bigger story

in emerging markets. Here, Chinese outbound investment is rebounding after the fallow Covid years, and is driving a new wave of industrialization that promises to lower the cost of the green-energy transition.

Why This Time Has Been Different

During past episodes of risk-off volatility, the correlation between emerging market risk assets has shot up. But early August’s bout of market volatility saw a bifurcation in EMs, and no broader macroeconomic spillover effects—which speaks well of the growing maturity of emerging markets as an asset class.

Europe's economy

Sweden As An Indicator Of Capital Flows

The debate over whether global investors are beginning to reduce exposure to US assets has intensified. After a decade of US equity outperformance, dollar strength and deep capital market dominance, signs of diversification are emerging. Sweden offers an unusually clear window into this change.

Poland’s Advantages

In recent years, Poland’s economy has grown far faster than those of neighbors Czechia, Hungary and Slovakia. This divergence within the “Visegrád Four” coincided with a sharp widening in Poland’s fiscal deficit from 1.7% of GDP in 2021 to around 6.8% in 2025. In this report, August explains why that fiscal largesse has not undermined the longer term Polish growth story, which continues to benefit from tailwinds as it plays catchup with economies to its west and protects against a menacing Russia to its east.

The Changing Of Lagarde

European Central Bank president Christine Lagarde is reportedly preparing to step down from her post at the ECB well before her term ends in October 2027. Whatever Lagarde’s intentions, it is certain that four of the six members of the ECB’s executive board will be replaced by the end of 2027. This prospective game of musical chairs was always likely to generate speculative headlines well in advance of the actual changes. In reality, there will be no simple bilateral stitch-up between Paris and Berlin.

European Equities Still Offer Catch-Up Potential

By anyone’s standards, European equities have had a spectacular run, fractionally beating the stoked-up US market since November 2022. However, given that one key argument for buying European equities has been their compelling valuation relative to US stocks, it has to be asked whether, following their three-year rally, European equities still offer attractive value.

Currencies

Video: Hong Kong’s Renminbi Question

What To Do With US$1trn?

On The False Price Of The Yen

Behind The Dollar’s Decline

A New Reflationary Force?

Don’t Bet On A Forever Weak Yen

Oil & commodities

Injurious Exposure

Dire Straits

Geoeconomic Monitor: The Iran Outcome

Is Clean Energy A Better Hedge Than Oil?

Geoeconomic Monitor: Who’s The Real Winner?

Geoeconomic Monitor: A Bad Oil Bet In Venezuela