Most recent

Gavekal Research

Behind The Dollar’s Decline

Will Denyer

28 Jan 2026

The US dollar took another leg down in Asian trading Wednesday. The DXY index dropped to 96, down -3% from levels around 98.8 as recently as last Thursday, breaking decisively below its trading range of the last seven months. Why is this weakness occurring now? And will it persist?

Gavekal Dragonomics

Anti-Corruption Strikes Again

Christopher Beddor

28 Jan 2026

China’s anti-graft investigators have netted their biggest catch in years: Zhang Youxia, deputy head of the Central Military Commission. Christopher argues that Zhang is only the latest target of an anti-corruption frenzy that continues unabated, which policymakers now say they will turn on the upcoming five-year plan—and in particular, the local-government officials implementing it.

Gavekal Research

Africa Becomes A Little More Asian

Joe Studwell

27 Jan 2026

Can Africa finally fulfill its development potential? Guest author Joe Studwell argues in his new book, How Africa Works, that African growth was held back by low population density. Now, the continent’s population density has reached the level of high-growth Asian countries in the 1960s. That, combined with big improvements in education, means that at least some African countries are poised for economic acceleration.

Gavekal Research

Beijing’s Military Purge And Markets

Louis-Vincent Gave

27 Jan 2026

In the summer of 2025, a purge at the top of China’s military hierarchy sent rumors flying that a coup was under way and that Chinese leader Xi Jinping was set to lose power. Six months later, another purge at the very top of China’s Central Military Commission has again led to much ink being spilled. Louis assesses whether this time is different.

Gavekal Dragonomics

Global Reflation Versus Domestic Deflation

Wei He, Thomas Gatley

Crossing A Currency Threshold

Wei He

Vanke Reaches A Deal

Xiaoxi Zhang

The Birth Dearth Deepens

Ernan Cui

Cushioning The Slowdown

Wei He, Dragonomics Team

Gavekal Research

A New Reflationary Force?

Louis-Vincent Gave

Geoeconomic Monitor: Greenland Derangement Syndrome

Tom Miller, Yanmei Xie

No Reform-Driven Rally For India

Udith Sikand, Tom Miller

Video: Why Are Europe’s Natural Gas Prices Rising?

Cedric Gemehl

What Not To Own In 2026

Charles Gave

Gavekal Technologies

The Lidar Revolution

Tom Hancock, Huang Shichan, Laila Khawaja

Beijing Accelerates Semiconductor Localization

Laila Khawaja

Manus AI’s Regulatory Odyssey

Laila Khawaja

China’s Bet On The Electrotech Stack

Arthur Kroeber, Laila Khawaja, Thomas Gatley

What To Watch In 2026

Laila Khawaja

Gavekal-IS

Measuring Imitation

Didier Darcet

The Manager’s Unspoken Truth

Didier Darcet

Gold And War

Didier Darcet

The Catastrophe

Didier Darcet

AI Bashing

Didier Darcet

Gavekal Research

Global Strategy: Best And Worst Trades For 2026

Louis-Vincent Gave, Charles Gave, Anatole Kaletsky, Will Denyer, Tan Kai Xian, Cedric Gemehl, August Gudmundsson, Thomas Gatley, Udith Sikand, Tom Miller

8 Jan 2026

Past performance is no guide to future returns, and the trend is not always your friend. As such, Gavekal writers consider their most compelling 10 macro trades for 2026, on both the upside and the downside. If one theme runs through our developed-market views, it is the expectation for a sustained inflationary boom. That story is different in China, but Chinese firms look to be on the right side of an energy transition with room to run. The view on gold is nuanced, especially seen through the lens of Japanese investors facing extreme asset valuations.

Checking The Boxes

Our short take on the latest news

Fact

Surprise

Takeaway

US Conference Board consumer confidence index fell to 84.5 in Jan, from 94.2 in Dec

Below expected 91

Labor components point to continued jobs market softness

France's INSEE consumer confidence index was at 90 in Jan, unchanged from Dec

As expected

Real wage growth and resilient labor market to support consumption

Spain's unemployment rate fell to 9.93% in 4Q25, from 10.45% in 3Q

Below expected 10.25%

Growth outperformance to continue in 2026 amid strong macro fundamentals

Australian CPI rose 3.8% YoY in Dec, versus 3.4% in Nov

Inlation above expected 3.6%; trimmed mean CPI rose 3.3% YoY in Dec, versus 3.2% in Nov

Continued uptick in inflation would solidify the case for RBA to shift to rate hikes

Test Your Knowledge

In 1970, South Africa produced around 70% of the world’s mined output of gold. What share does it produce today?

- 3%

- 14%

- 27%

- 59%

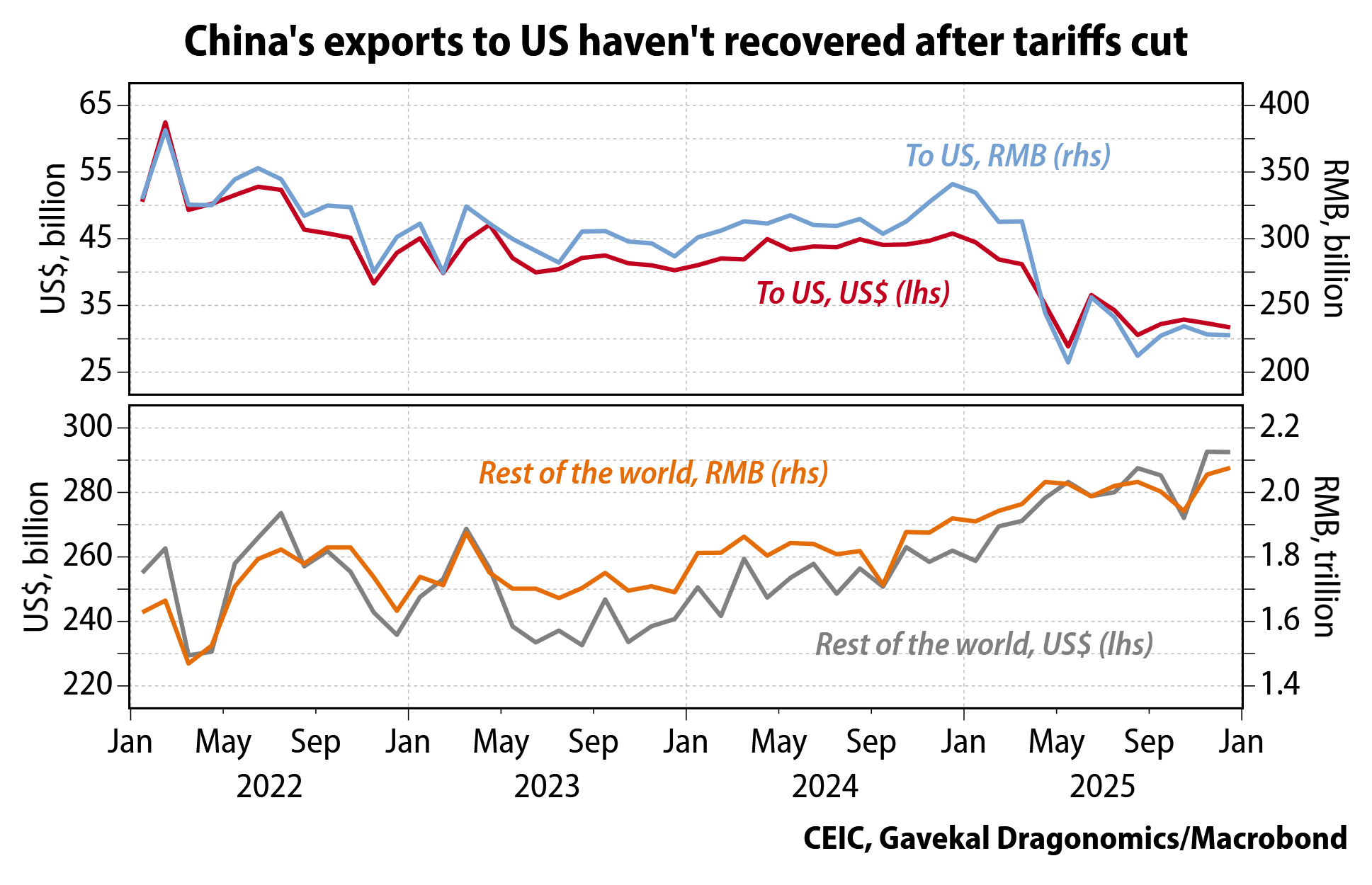

Chart of the Week

China’s exports rose 6.6% YoY in December, beating market expectations. But exports to the US did not pick up, even after the -10pp US tariff reduction on Chinese goods agreed as part of the trade-war ceasefire. That might be just a temporary blip due to high US inventory levels, or perhaps because buyers are wary of recommitting too quickly to Chinese suppliers. But with duties down and the transshipment route via Mexico increasingly difficult, China’s direct trade with the US should pick up in 2026.

Open Chart

Gavekal Research

Essential Reading: A Book For Every Week Of The Year

Gavekal is often asked for a recommended reading list. So, here it is: a book a week that everyone interested in the world of macro investing—whether hoary veteran or eager apprentice—can benefit from reading.

Gavekal Research

Webinar: Spheres Of Interest

Louis-Vincent Gave, Tom Miller, Tom Holland

16 Jan 2026

The United States' capture of Venezuelan president Nicolás Maduro threatens a full rupture of the already severely frayed rules-based international order. In this webinar, our team assessed the economic impact of a world dividing into competing spheres of interest and ask what this means for financial markets, especially energy and commodities.

Tariff Troubles

The EM Triple Whammy On Full Display

It would be tempting to ascribe the simultaneous US dollar, bond, and equity market sell-off to the self-owned “crisis” around Greenland and to Trump’s threat to use tariffs against (former?) friends to force a change of sovereignty. Still, the current sell-off in bonds, and equities, may also be driven by other important factors, says Louis.

How Europe Will Respond To Trump’s Greenland Tariffs

On Saturday, US president Donald Trump threatened new tariffs on eight European countries over their opposition to his plans to annex Greenland. Since then, attention has shifted to how Europe might respond. Cedric argues that conciliation and deescalation remains Europe’s first response to Trump’s new tariff threat, but there is now a greater chance that the EU retaliates in earnest if that strategy fails.

Video: Supreme Court v. Trump’s Trade Policy

Initial questioning by US Supreme Court justices in a landmark trade policy case suggests that a majority believe the Trump administration unlawfully invoked emergency powers to impose broad tariffs on importers. In this interview, Will outlines the key issues at stake and considers Trump’s possible next steps if the government loses.

Geoeconomic Monitor: Understanding The New Trade Regime

In today’s Monitor, we continue our analysis of what Donald Trump’s new trade regime means for the world economy, explain how Indian prime minister Narendra Modi blundered and wound up facing a 50% tariff, and argue that none of the conditions for a quick end to the Russia-Ukraine war are in place.

US economy & markets

Behind The Dollar’s Decline

The US dollar took another leg down in Asian trading Wednesday. The DXY index dropped to 96, down -3% from levels around 98.8 as recently as last Thursday, breaking decisively below its trading range of the last seven months. Why is this weakness occurring now? And will it persist?

Central Bank Balance Sheets In 2026

After spiking money market rates forced the US Federal Reserve to switch from balance sheet contraction to balance sheet expansion via asset purchases in December, Cedric and Will look at whether liquidity stresses could trigger a similar U-turn in 2026 from the European Central Bank.

Politics In Electricity

US politics is sharpening its focus on electricity prices. Power costs in the consumer price index far outpaced the headline rate, making the issue unavoidable ahead of November’s midterm elections. Both Republicans and Democrats are increasingly converging on a similar framing, with artificial intelligence data centers cast as a villainous driver of rising power costs. KX examines what this means for investors.

Why Is Trump Still Gunning For Powell?

On Friday, the US Department of Justice issued subpoenas threatening Federal Reserve chairman Jerome Powell with criminal charges. With Powell’s term as chair up in just four months, why is Donald Trump picking a fight now when Powell is on the way out anyway? Will explores the possible explanations and assesses their market implications.

China chartbook

Gavekal Dragonomics

The Chinese Consumer In 2025

Ernan Cui

24 Nov 2025

China’s household consumption growth has weakened further in 2025, primarily driven by the weak labor market and slowing household income growth. Policymakers have announced several new measures to boost spending, but there are also reasons to think that the slowdown might continue. In her annual chartbook, Ernan breaks down the key cyclical and structural drivers of household consumption, and explores what it means for consumer spending in the months to come.

India chartbook

Gavekal Research

India Macro Update: Downside Risks Abound

Udith Sikand, Tom Miller

23 Sep 2025

India’s domestic economic recovery is at risk as Prime Minister Narendra Modi’s government faces a lose-lose choice: continue to import cheap oil from its long-time ally Russia or face punitive tariffs in its biggest export market. Last week’s US interest rate cut will give the central bank more room to cut rates, but the underperformance of Indian asset prices looks set to continue.

Latest video

Gavekal Research

Video: Why Are Europe’s Natural Gas Prices Rising?

Cedric Gemehl

22 Jan 2026

After Europe’s benchmark price for natural gas spiked by 40% between the first and third weeks of January, Cedric Gemehl examines the state of the continent’s gas stores, asks where European countries can source additional imports, and considers the longer term questions raised by Europe’s energy insecurity.

Strategy Chartbook

Gavekal Research

Global Strategy: Best And Worst Trades For 2026

Louis-Vincent Gave, Charles Gave, Anatole Kaletsky, Will Denyer, Tan Kai Xian, Cedric Gemehl, August Gudmundsson, Thomas Gatley, Udith Sikand, Tom Miller

8 Jan 2026

Past performance is no guide to future returns, and the trend is not always your friend. As such, Gavekal writers consider their most compelling 10 macro trades for 2026, on both the upside and the downside. If one theme runs through our developed-market views, it is the expectation for a sustained inflationary boom. That story is different in China, but Chinese firms look to be on the right side of an energy transition with room to run. The view on gold is nuanced, especially seen through the lens of Japanese investors facing extreme asset valuations.

Emerging markets

Video: Are EMs Back?

It’s been a good quarter for the broad emerging markets complex. The MSCI EM index has returned almost 7% in US dollar terms, while US equities are down by some -3.5%. So should investors jump on the EM train? Udith points out that there is a wide divergence in the performance of individual emerging markets, and the threat of tariffs hangs heavy over EM corporate earnings. Investors need to be selective.

Video: Southeast Asia Under Trump 2.0

Global investors are rightly focused on the potential losers from the United States pursuing an aggressively protectionist trade policy agenda, but there may be winners as well. Tom went in search of such economies last week. Today he explains how such “swing states” are likely to perform in an intensified period of great power rivalry between the US and China.

China Turbocharges EM Investment

As the rich world pulls up the protectionist drawbridge, investors risk missing a bigger story

in emerging markets. Here, Chinese outbound investment is rebounding after the fallow Covid years, and is driving a new wave of industrialization that promises to lower the cost of the green-energy transition.

Why This Time Has Been Different

During past episodes of risk-off volatility, the correlation between emerging market risk assets has shot up. But early August’s bout of market volatility saw a bifurcation in EMs, and no broader macroeconomic spillover effects—which speaks well of the growing maturity of emerging markets as an asset class.

Europe's economy

Central Bank Balance Sheets In 2026

After spiking money market rates forced the US Federal Reserve to switch from balance sheet contraction to balance sheet expansion via asset purchases in December, Cedric and Will look at whether liquidity stresses could trigger a similar U-turn in 2026 from the European Central Bank.

How Europe Will Respond To Trump’s Greenland Tariffs

On Saturday, US president Donald Trump threatened new tariffs on eight European countries over their opposition to his plans to annex Greenland. Since then, attention has shifted to how Europe might respond. Cedric argues that conciliation and deescalation remains Europe’s first response to Trump’s new tariff threat, but there is now a greater chance that the EU retaliates in earnest if that strategy fails.

The Next Stage Of The Eurozone Cycle

The eurozone economy ended 2025 in an apparent not-too-hot, not-too-cold equilibrium. At first glance, it seems like Europe is stuck in first gear, but looking at 2026, it is more likely that the eurozone economy shifts up a gear into a mild inflationary boom, as strengthening domestic demand offsets the drag from external shocks.

Four Market Mispricings

Last week, Louis considered four contrarian trades for 2026 but expressed some skepticism about all of them. In this piece, Anatole suggests a variant on this concept, but offers a high conviction view: four market mispricings which reflect ideas about the world economy that are already shared by many investors but not yet reflected in market prices, even though market trends have already started moving in a direction consistent with these ideas.

Currencies

Behind The Dollar’s Decline

A New Reflationary Force?

Don’t Bet On A Forever Weak Yen

How To Think About Renminbi Appreciation

Rubik’s ECB

Resolving The Renminbi Anomaly

Oil & commodities

Geoeconomic Monitor: A Bad Oil Bet In Venezuela

Geoeconomic Monitor: Working On Credibility

Axis Of Energy

Convictions And Concerns

The Petro-Currency That Wasn’t

Geoeconomic Monitor: Digital Currencies And Financial Power