Most Recent

Gavekal Research

Big Versus Small: America’s Two-Speed Economy

Will Denyer, Tan Kai Xian

26 Apr 2024

Investors greeted 2024 by cheering an apparent disinflationary boom. Then, inflation picked up in the first quarter and markets began to clock an inflationary boom. Just as investors were settling down, Thursday’s GDP release threw a spanner in the works. Will and Kai Xian seek to understand this shifting dynamic with reference to a two-speed dynamic that has been affecting different areas of the US economy differently.

Gavekal Dragonomics

Macro Update: Supply Outpaces Demand

Andrew Batson, Dragonomics Team

26 Apr 2024

China’s growth has stabilized but its imbalances remain. Prices are falling, inventories are rising, capacity utilization is low and hiring is weak. The government’s strategy of prioritizing supply over demand risks entrenching this dynamic. In our quarterly chartbook, the Dragonomics team breaks down the latest economic developments and reviews the implications.

Gavekal Research

Biden's Options

Louis-Vincent Gave

26 Apr 2024

Incumbents usually do what they can to boost economic growth ahead of the election. However, with a little over six months to go before 2024’s election, the latest economic data has left most market participants disappointed. So, what economic policies can Joe Biden’s administration roll out between now and November to tip the scales in the Democrats’ favor?

Gavekal Research

Video: The Problem With France

Cedric Gemehl

26 Apr 2024

France’s government debt readings keep going from bad to worse, yet sovereign bond investors do not seem to be punishing policymakers for their spendthrift ways. In this video, Cedric explores different political scenarios that could upset the French apple cart.

Gavekal Dragonomics

The Worsening Property Outlook

Rosealea Yao, Xiaoxi Zhang

What Are State Assets For?

Andrew Batson

Xi’s Vision For Finance

Xiaoxi Zhang

The Middling Growth Trap

Wei He, Dragonomics Team

Global Growth To The Rescue

Wei He

Benchmarking Social Housing Progress

Rosealea Yao

Migration Stagnation

Ernan Cui

China Electrifies

Haixu Qiu

China’s Savers Turn To Gold

Thomas Gatley, Wei He

Managing The Local Fiscal Drag

Xiaoxi Zhang

More Research

Webinar: Into The Upswing

Will Denyer, Cedric Gemehl, Wei He, Udith Sikand

Can Vietnam’s Growth Miracle Remain On Track?

Tom Miller, Thomas Gatley, Udith Sikand

Honestly, Why Bother With Sanctions?

Tom Holland

The Achilles Heel Of Emerging Market Debt

Louis-Vincent Gave

Turning Turkish II

Charles Gave, Louis-Vincent Gave

Is The Bank Of England More Like The ECB Or The Fed?

Cedric Gemehl

A Question To Challenge The Deflationary Mindset

Louis-Vincent Gave

Yellen’s Intervention Imprimatur

Udith Sikand

Video: Wading Into The South China Sea

Yanmei Xie

The Repricing Has Further To Run

Will Denyer

Gavekal Research

What Could Spoil The Inflationary Boom?

Louis-Vincent Gave

2 Apr 2024

Usually when yields and the US dollar rise simultaneously, commodities—and especially gold—tend to trade “heavy.” The exception comes when the economy happens to be in an inflationary boom. And as it turns out, most of the recently published data appear to

point to this very scenario.

The global view

Turning Turkish II

In this paper, Louis and Charles explore the disturbing possibility that it may not be that stocks are in a bubble, but that developed world bond markets—and the currencies on which they are based—are suffering a structural erosion of their value, causing investors to seek safety in assets such as equities and gold with intrinsic real-economy worth.

A Question To Challenge The Deflationary Mindset

With rising US treasury yields causing pain in the currency markets and now among US growth stocks, investors will be wondering what the rise in yields will break next. Could rising yields break the back of the gold bull market? Or the unfolding emerging market boom? What about economic growth in general? In such an environment, are government bonds still the default risk-free asset?

Webinar: Forward To The 1970s? Investing For An Inflationary Age

With inflation reaccelerating in the US, energy prices rising and escalating conflict in the Middle East, 2024 is beginning to feel uncomfortably reminiscent of the early 1970s. In this webinar, Gavekal’s founding partners examine how investors have mispriced the risk of permanently higher inflation, and discuss how to structure portfolios for a less forgiving macro environment in which bonds no longer serve to hedge exposure to equities.

The 2024 Commodity Surge

With the broad commodity complex up some 13% year-to-date, commodities are closing in on their 2022 highs. However, Louis argues there is more to this rally than heightened geopolitical risks, which were responsible for driving the 2022 run-up.

Test Your Knowledge

In 2022, Apple had 48 Chinese suppliers. What was the number in 2023?

Post Your Answer

Chart of the Week

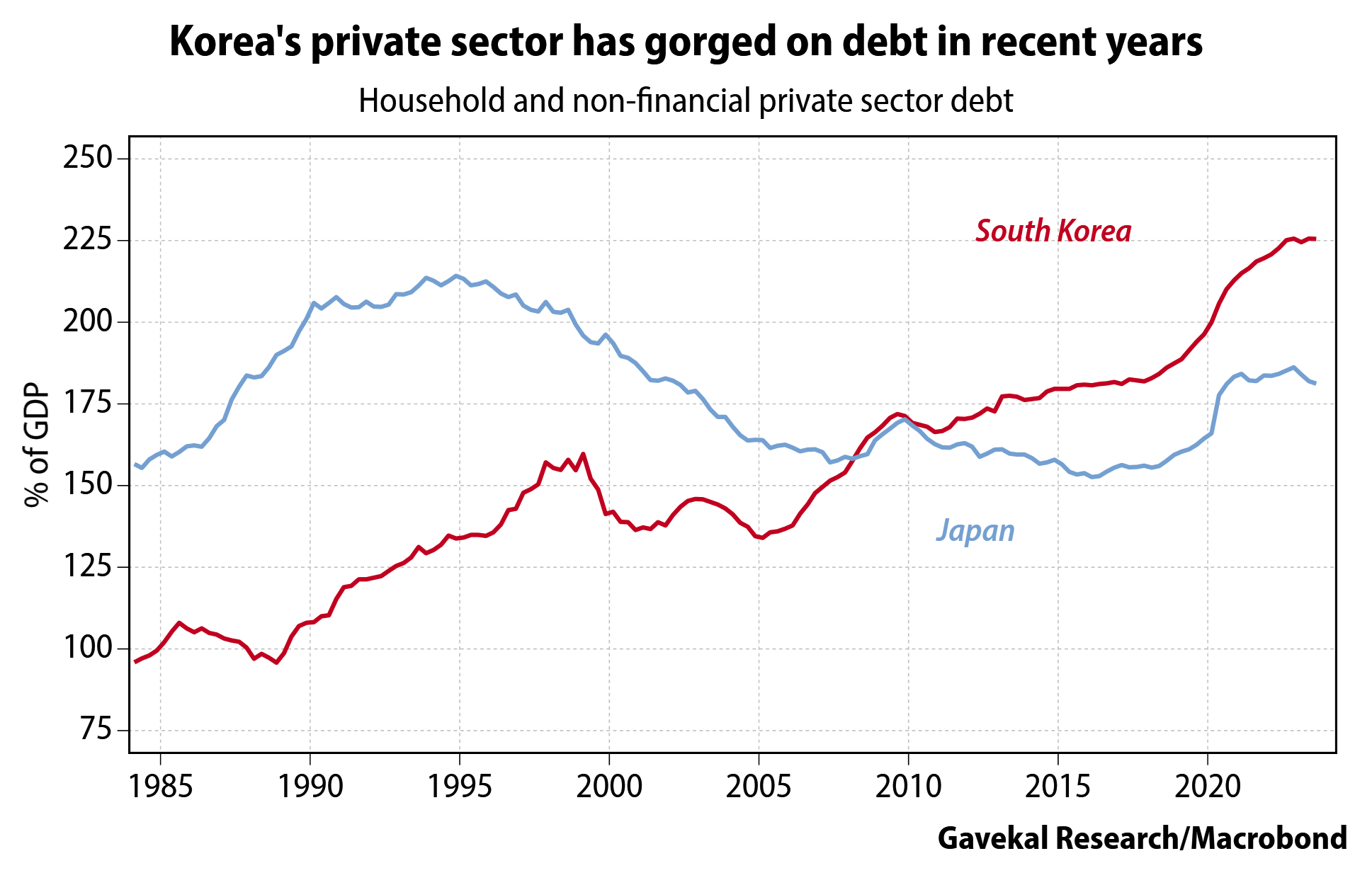

South Korea and Japan are two economies often lumped together for their similarly poor demographic profiles. But in recent years, an important distinction between the two economies has been the trajectory of private sector debt. After a protracted spell of deflationary impulses that incentivized deleveraging among households and corporates, the Japanese private sector has only recently started to take on more leverage. By contrast, South Korea’s private sector debt-to-GDP ratio has risen by more than 50pp over the past decade to 225%, higher than Japan's peak in the 1990s.

Open Chart

Gavekal Research

Essential Reading: A Book For Every Week Of The Year

Gavekal is often asked for a recommended reading list. So, here it is: a book a week that everyone interested in the world of macro investing—whether hoary veteran or eager apprentice—can benefit from reading.

US economy & markets

Big Versus Small: America’s Two-Speed Economy

Investors greeted 2024 by cheering an apparent disinflationary boom. Then, inflation picked up in the first quarter and markets began to clock an inflationary boom. Just as investors were settling down, Thursday’s GDP release threw a spanner in the works. Will and Kai Xian seek to understand this shifting dynamic with reference to a two-speed dynamic that has been affecting different areas of the US economy differently.

The Repricing Has Further To Run

As of Wednesday’s close, the S&P 500 was down -4.4% from its end-March high as the market continued to price in the realization that with inflation reaccelerating, US interest rates will remain higher for longer. This repricing may have further to run.

The Impact Of Big Government

The Covid pandemic was a watershed moment, spurring Western governments to get more involved in economic management than any time in the last 50 years. Kai Xian and Cedric assess the way that Covid-era fiscal support has been transmitted to private sector balance sheets—and how this is affecting current economic performance.

US Reflation And The Markets

At the start of 2024, the US seemed to be settling into a disinflationary boom. However, over the first three months of 2024, CPI rose at an annualized rate of 4.6%, while core CPI rose 4.5%. This qualifies as enough of a trend to significantly delay rate cuts, if not take them off the table entirely, and it is time to reassess the outlook for inflation, interest rates and markets.

Gavekal Research

Webinar: Into The Upswing

Will Denyer, Cedric Gemehl, Wei He, Udith Sikand

25 Apr 2024

In this webinar Gavekal’s analysts review the themes driving growth across the world’s major economic regions, and discuss how macro developments are likely to drive financial markets over the remainder of 2024.

Emerging markets

Webinar: Into The Upswing

In this webinar Gavekal’s analysts review the themes driving growth across the world’s major economic regions, and discuss how macro developments are likely to drive financial markets over the remainder of 2024.

Webinar: Animal Spirits In The Emerging Markets

While US tech stocks have been getting all the publicity, capital has quietly been flowing into emerging market investments over recent months. To gauge market prospects over the rest of 2024, Udith Sikand examined the macroeconomic outlook for the major emerging markets ex-China, while Thomas Gatley assessed the chances of a revival of animal spirits in the Middle Kingdom.

EM Debt Market Issuance Cranks Up

Heightened US bond market volatility has often coincided with emerging-market assets incurring higher risk premiums. That was then. This cycle has differed since emerging markets have survived the most aggressive Fed tightening cycle in a generation with minimal fuss. So what accounts for EMs’ apparent new-found resilience?

The China-EM Equity Decoupling

Global investors have long treated Chinese and other emerging-market equities as a single asset class. Those days may now be over. Thomas and Udith examine why declining US treasury yields and a weakening dollar have spurred capital flows into emerging markets, but foreign investors continue to pull money out of Chinese equity markets.

Latest video

Gavekal Research

Video: The Problem With France

Cedric Gemehl

26 Apr 2024

France’s government debt readings keep going from bad to worse, yet sovereign bond investors do not seem to be punishing policymakers for their spendthrift ways. In this video, Cedric explores different political scenarios that could upset the French apple cart.

India chartbook

Gavekal Research

India Macro Update: Shifting Into Overdrive

Udith Sikand, Tom Miller

27 Mar 2024

India is cementing itself as a reliable engine of growth for the global economy, state Udith and Tom. Although headline GDP figures exaggerate the robustness of India’s growth, there is no denying the favorable tailwinds Private sector capital spending, bonds, and to a lesser extent the rupee, should offer upside in the near term. By contrast, the prospects for Indian stocks—where regulators are looking to curb signs of excess—are less rosy.

China chartbook

Gavekal Dragonomics

Macro Update: Supply Outpaces Demand

Andrew Batson, Dragonomics Team

26 Apr 2024

China’s growth has stabilized but its imbalances remain. Prices are falling, inventories are rising, capacity utilization is low and hiring is weak. The government’s strategy of prioritizing supply over demand risks entrenching this dynamic. In our quarterly chartbook, the Dragonomics team breaks down the latest economic developments and reviews the implications.

Europe's economy

Is The Bank Of England More Like The ECB Or The Fed?

US inflation has ticked up again, and expectations have changed drastically. Today, the market is only pricing in one Fed rate cut by November. However, European markets expect the ECB to be more dovish, and are still pricing in an 80% probability of a June rate cut, with a sizable chance of a second in July. So where does this leave the Bank of England?

The Impact Of Big Government

The Covid pandemic was a watershed moment, spurring Western governments to get more involved in economic management than any time in the last 50 years. Kai Xian and Cedric assess the way that Covid-era fiscal support has been transmitted to private sector balance sheets—and how this is affecting current economic performance.

Unpicking The Europe-China Deficit

After a blowout during the pandemic, the European Union’s trade deficit with China has almost normalized. So are hawkish European officials preparing punitive trade policies to fix a problem that has taken care of itself? Cedric and Thomas examine the trade data and find the answer is “no.” The improvement in the deficit looks to have run its course and may be about to reverse.

Landing At Altitude

Since peaking at 10.6% year-on-year in October 2022, the eurozone’s headline consumer inflation rate has fallen almost without interruption to just 2.4% YoY in March. This brings the European Central Bank’s target rate of 2% into sight. But will inflation sink below that threshold, as it did throughout most of the decade before Covid?

Gavekal Research

Strategy Monthly: India’s Juggernaut Gathers Momentum

Udith Sikand, Tom Miller

4 Dec 2023

In a world desperately short of good growth stories, India stands out as the world’s fastest-growing major economy, with favorable demographics and geopolitical tailwinds. Thursday’s GDP release showing growth at a scorching 7.6% YoY will only reinforce the excitement among investors.

Equities

Webinar: Into The Upswing

Turning Turkish II

The Repricing Has Further To Run

Webinar: Forward To The 1970s? Investing For An Inflationary Age

The Limits Of K-Value

Are European Equities Cheap?

Oil & commodities

Honestly, Why Bother With Sanctions?

The 2024 Commodity Surge

How High Will The Oil Price Go?

Trump 2

The Long And Short Of Energy Risk

China’s Red Sea Calculus

China tech

Vietnam’s Bamboo Diplomacy

Big Tech’s Rearguard Action

TikTok, Big Tech And Risk Premiums

Video: The Importance Of TikTok

The Coming Price War In Chips

Geopolitical Uncertainty And Record Valuations On Semi Stocks

The Inflation Question

A Question To Challenge The Deflationary Mindset

With rising US treasury yields causing pain in the currency markets and now among US growth stocks, investors will be wondering what the rise in yields will break next. Could rising yields break the back of the gold bull market? Or the unfolding emerging market boom? What about economic growth in general? In such an environment, are government bonds still the default risk-free asset?

Three Charts To Watch

Charles today is chiefly concerned about US inflation, the French economy and a potential downturn in it, causing a euro crisis. As a result, he is monitoring these three charts.

US Reflation And The Markets

At the start of 2024, the US seemed to be settling into a disinflationary boom. However, over the first three months of 2024, CPI rose at an annualized rate of 4.6%, while core CPI rose 4.5%. This qualifies as enough of a trend to significantly delay rate cuts, if not take them off the table entirely, and it is time to reassess the outlook for inflation, interest rates and markets.

Video: The Employment-Immigration-Inflation Nexus

Even as US employment growth has remained strong in recent months, wage growth has continued to ease. Kai Xian attributes this paradox in part to rapid immigration into the US, which is supporting the supply of new workers. This implies that immigration policy will have a significant influence on the US labor market, wage growth and inflation over the coming years.